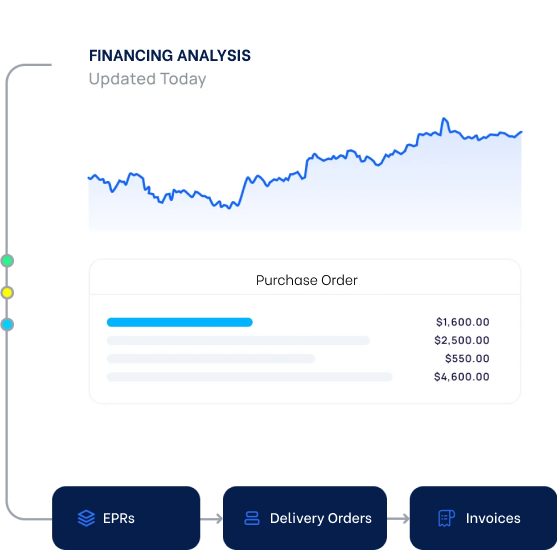

Unlock Financial Flexibility with Payables Financing

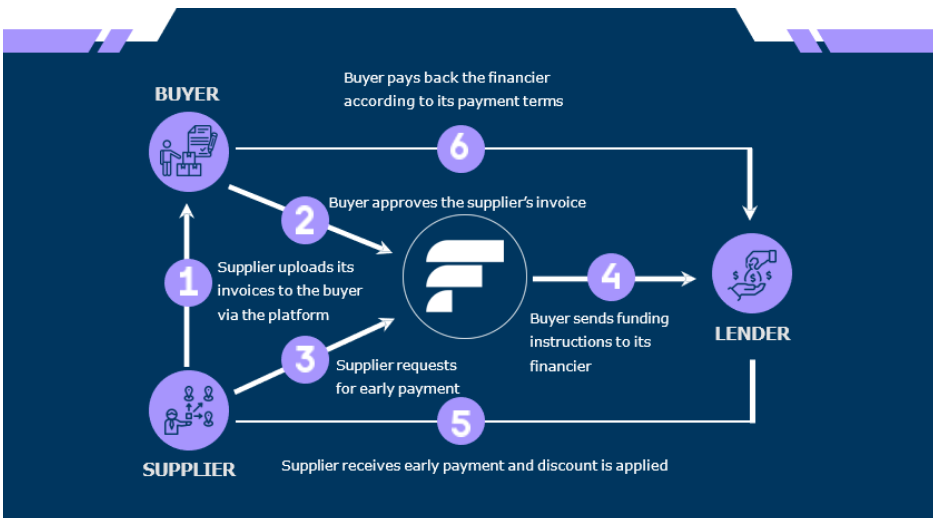

HOW DOES IT WORK?

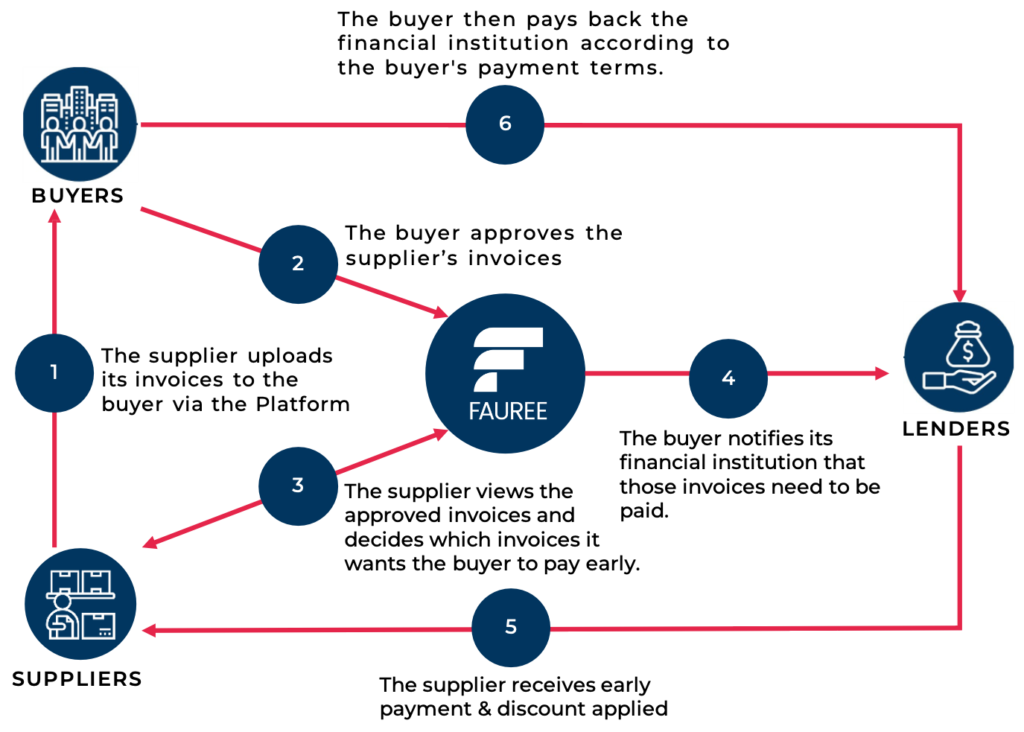

HOW DOES IT WORK?

01

02

03

04

05

06

Improved Cash Flow

Companies manage cash flow effectively by accelerating supplier payments.

Strengthened Supplier Relationships

Demonstrates commitment to timely payments, fostering trust and goodwill.

Reduced Reliance on Traditional Financing

Suppliers benefit from predictable cash flow, reducing dependence on bank loans.

Benefits of Payable Financing Solution

For a Buyer

Allows buyers to pay suppliers earlier, managing cash flow effectively.

Demonstrates commitment to meeting financial obligations, fostering trust and goodwill.

Optimizes financial resources by managing payables efficiently.

Provides flexibility in managing payment terms and financial obligations.

Can lead to lower borrowing costs by optimizing cash flow and reducing reliance on loans.

For a Supplier

Allows suppliers to receive payment earlier, improving cash flow management.

Enhances relationships with buyers, as suppliers see commitment to their financial stability.

Reduces reliance on traditional financing, freeing up capital for growth initiatives.

Improves payment predictability, allowing for better financial planning.

Improves financial stability by ensuring timely payments from buyers, reducing the need for expensive short-term financing options.

Explore the power of innovation with Fauree

Experience the power of innovation with Fauree

What is Payable Financing (Reverse Factoring) &

How Does it Work?

Payable financing: Also known as Reverse factoring, is a financing solution that allows a company to pay its suppliers earlier than the agreed payment terms. It is typically offered by a financial institution or a third-party provider (Lender/Financier) who acts as an intermediary between the buyer and its suppliers.

The buyer enters into an agreement with the payable financing provider, who then contacts the company’s suppliers and offers them the option to receive their payments earlier than the agreed payment terms. The supplier can choose to accept the offer, in which case they will receive payment from the lender, who will then recover the funds from the buyer at a later date.

By participating in a payable financing solution, companies can improve their cash flow by paying their suppliers earlier than the agreed payment terms. This can be especially useful for companies that have a large number of outstanding invoices and need to manage their cash flow effectively. Payable financing can also help companies strengthen their relationships with their suppliers, as it demonstrates a commitment to meeting financial obligations and can help to build trust and goodwill. It can also help suppliers reduce their reliance on traditional forms of financing, such as bank loans.

Benefits of Payables Finance solution

Buyer Benefits

Improved cash flow

Stronger supplier relationships

Increased working capital

Greater financial flexibility

Reduced borrowing costs

For buyers, payable financing can provide improved cash flow by allowing them to pay their suppliers earlier than the agreed payment terms. This can be especially useful for companies that have a large number of outstanding invoices and need to manage their cash flow effectively. Reverse factoring can also help buyers to strengthen their relationships with their suppliers, as it demonstrates a commitment to meeting financial obligations and can help to build trust and goodwill.

Supplier Benefits

Improved cash flow

Enhanced financial stability

Reduced reliance on traditional forms of financing

Stronger relationships with buyers

Improved payment predictability

For sellers, payable financing can provide improved cash flow by allowing them to receive payment earlier than the agreed payment terms. This can help sellers to better manage their cash flow and reduce their reliance on traditional forms of financing, such as bank loans. Reverse factoring can also enhance sellers’ financial stability and improve their payment predictability, as they will know when they can expect to receive payment from their buyers. Finally, participating in a reverse factoring program can help sellers to strengthen their relationships with their buyers and can improve their overall financial performance.